Real estate loan merchant Skyrocket Home loan was increasing to the Canada

3 de setembro de 2024Каким образом предоставляются free spins в казино в Интернете Кент казино: экспертный обзор

3 de setembro de 2024It is the right time to earn some larger alter. Ready to in the end get to one bathroom redesign you have been thinking regarding the? Considering a different auto, otherwise consolidating the their an excellent loans? A HELOC, otherwise household collateral line of credit, was a powerful way to fund large lifetime alter.

Here is how a great HELOC functions: its a credit line that is in line with the worth of your house. An excellent HELOC can be used for a selection of home improvement strategies such as for example renovations otherwise enhancements, but it could also be used to help you refinance other types of debt if you don’t finance advanced schooling. A potential escalation in house worthy of you will definitely mean you’ve got even more collateral readily available for borrowing. Find out about just what an excellent HELOC was and exactly how it may help you.

Just how does the fresh new HELOC software processes work? All banking institutions and you may loan providers do it quite in a different way, however the HELOC app processes from the Santander Lender is straightforward and you may quick. This is how to acquire a home guarantee personal line of credit during the 9 easy steps.

Step one: Look at your Credit history

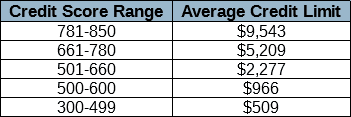

Before you start your own HELOC software, it can be beneficial to bring a moment to check out your credit score. The lender can look at your score within the choice procedure, making it far better enter with your vision wide-open. If it is not in which you want it to be, take time knowing just how to improve your credit score.

Step 2: Rating Planned

You ought not risk initiate the application and also have so you’re able to stop to check out a bunch of paperwork, especially if you ran to your your local lender part. Take the time to collect upwards exactly what you’ll need to fill out of the initial application. Even though it may differ depending on exactly who the financial are, you will likely you want:

- Public Shelter Count

- Income guidance and a position records

- Facts about your house, together with your full mortgage equilibrium, home loan repayments, taxes and you can insurance coverage suggestions

- Pointers regarding their other a good personal debt and you will normal monthly payments

3: Submit an application for An excellent HELOC

You can find an easy way to apply for a house Collateral Range from Credit. On Santander Lender, you can visit the local financial part , call that loan Professional, or get a house Guarantee Credit line on the web. If you find yourself filling in the program online and have all their expected data files up and running, the procedure should not take a long time. But if you provides questions regarding a home Equity Collection of Credit, speaking on the phone or perhaps in people that have financing Professional is a great idea! Regardless of where you submit your application, you will need to offer your own personal guidance, your earnings, a job and you may present loans, and an obtain how much cash you’d like to use. Additionally, you will have to bring factual statements about the fresh guarantee your wish to guarantee, in this case a home you own, just like your mortgage equilibrium, monthly payments, taxes and you can insurance coverage.

Step: Make sure Your earnings

Shortly after your application has been received, a loan Professional have a tendency to contact you to be certain that your income and you may reveal what records you need to bring. This includes your earnings from the manager, which can be confirmed with pay stubs or a good W-2, but there are many sourced elements of money and this want proof also. Such as for example, for many who receive money away from a rental assets, a retirement, otherwise alimony, you will have to were verification data for that also.

Step 5: Await The Initial Decision

We know, waiting could possibly be the worst. However,, contained in this step three working days, the loan underwriter will send you a letter toward 1st credit decision along with the conditions and terms if the approved. The borrowed funds underwriter have a tendency to comment your credit history, including your credit score and you will any a great money you may have, and compare to your current earnings. Which calculation is named your debt-to-earnings proportion. They are going to in addition to remark the degree of one current mortgage loans, are the amount of the loan demand and you may contrast that in order to the new projected worth of your house (known as the financing-to-really worth proportion).

Action six: The newest Assessment Process

Around will not be continuously you want to do for this step. Their bank otherwise bank will now assess the latest property value your property, that will prove just how much equity available. An enthusiastic appraiser might require use of your house and also make this determination, this really is not at all times expected.

Action eight: Closing Big date

Use the new wine and start exercising their signature! After the appraisal, their bank will touch base and you may inform you for people who have received finally recognition plus the terms of the arrangement. They plus agenda an ending big date with you. Your, of course, if relevant their co-applicant, will have to have your preferred branch and you may to remain the newest dotted line.

Step 8: Opinion All the Documents

Need time to search through everything? After things are specialized, you may have step three business days to examine the documents and can determine not to ever move on to unlock the personal line of credit that have free of charge otherwise obligations, unless of course your HELOC will be covered by the a residential property.

Step nine: Begin using Your own HELOC

On the last big date immediately after closing, might actually have use of money on your own collection of credit to your own limit range for the length of the latest mark months, unless your own HELOC would be secured of the an investment property. Possible receive money either by composing a check, visiting a part, otherwise and also make an internet transfer from your personal line of credit to the your Santander savings account. Speak to your department user to talk small payday loan about how best to view and you can take control of your new home Security Personal line of credit.