Angeschlossen Casinos über 5 Ecu Einzahlung Bestes 5 Eur Casino 2024

5 de novembro de 2024Damen- & Herrenmode verbunden vorbestellen

5 de novembro de 2024Katherine Watt try good CNET Money author targeting mortgages, family guarantee and you may financial. She before blogged on the personal funds for NextAdvisor. Situated in Nyc, Katherine finished summa spunk laude regarding Colgate School having a beneficial bachelor’s training inside English books.

Laura is a specialist nitpicker and you will an excellent-humored troubleshooter along with ten years of experience in publications and you can electronic publishing. In advance of to be an editor which have CNET, she did as an English teacher, Spanish medical interpreter, content publisher and you can proofreader. This woman is a brave but flexible defender regarding one another sentence structure and weightlifting, and completely thinks one tech is to suffice people. Her basic computers is actually a great Macintosh Also.

CNET teams — maybe not business owners, partners or business welfare — regulate how we remark the merchandise and you will attributes we security. If you buy through the website links, we could possibly get paid.

- Mortgage

- 30-year fixed-price

Katherine Watt was a CNET Currency copywriter emphasizing mortgage loans, household collateral and financial. She previously wrote about personal fund having NextAdvisor. Based in New york, Katherine graduated summa cum laude from Colgate College which have a beneficial bachelor’s knowledge in English literature.

Laura is actually an expert nitpicker and you may a beneficial-humored troubleshooter with more than a decade of expertise in publications and digital posting. Ahead of are an editor which have CNET, she did given that a keen English professor, Foreign language scientific interpreter, copy editor and you will proofreader. The woman is a brave but flexible defender out-of each other grammar and you will weightlifting, and you will completely believes one tech is suffice the people. Their basic computer system are good Macintosh In addition to.

CNET personnel — maybe not advertisers, lovers otherwise team passions — regulate how we remark these products and you will features i protection. If you purchase owing to our very own backlinks, we may receive money.

Today’s prices

- The current mediocre re-finance prices

- Today’s re-finance rates trend

- In which re-finance cost try lead during the 2024

- How much does it imply so you’re able cashadvancecompass.com variable rate loan to re-finance?

- Selecting the right re-finance style of and title

- Grounds you could re-finance your house

Given that the new Government Set-aside have commercially arrived at lower notice rates, people should expect home loan re-finance rates in order to gradually decline. Over the past 2 years, flooding home loan prices provides required refinancing isn’t an option for very home owners, just like the bulk now have mortgage loan prices below six%.

Now that cost have begun to go off, refinancing craft is actually much slower picking up. The reduced home loan pricing fall, the greater home owners will financially benefit from refinancing their house fund. To read through more info on a week home loan forecasts, come across here.

The present mediocre re-finance rates

The fresh Government Set aside is beginning to cut interest levels, and financial costs are already down. Have the best rate for the situation because of the contrasting several mortgage has the benefit of away from different lenders. Receive a custom made estimate from a single out-of CNET’s mate loan providers because of the entering your information below.

In the such cost: Such as for instance CNET, Bankrate is actually belonging to Red Ventures. This equipment keeps mate pricing out-of loan providers that can be used when comparing several financial rates.

The current re-finance price trend

Having rising cost of living cooling, and with the Fed’s move towards reducing rates of interest, home loan refinance costs have refuted rather. In fact, before new central financial cut interest levels of the 0.5% towards Sept. 18, financial prices started initially to drop, with average home loan cost today close to six.2%.

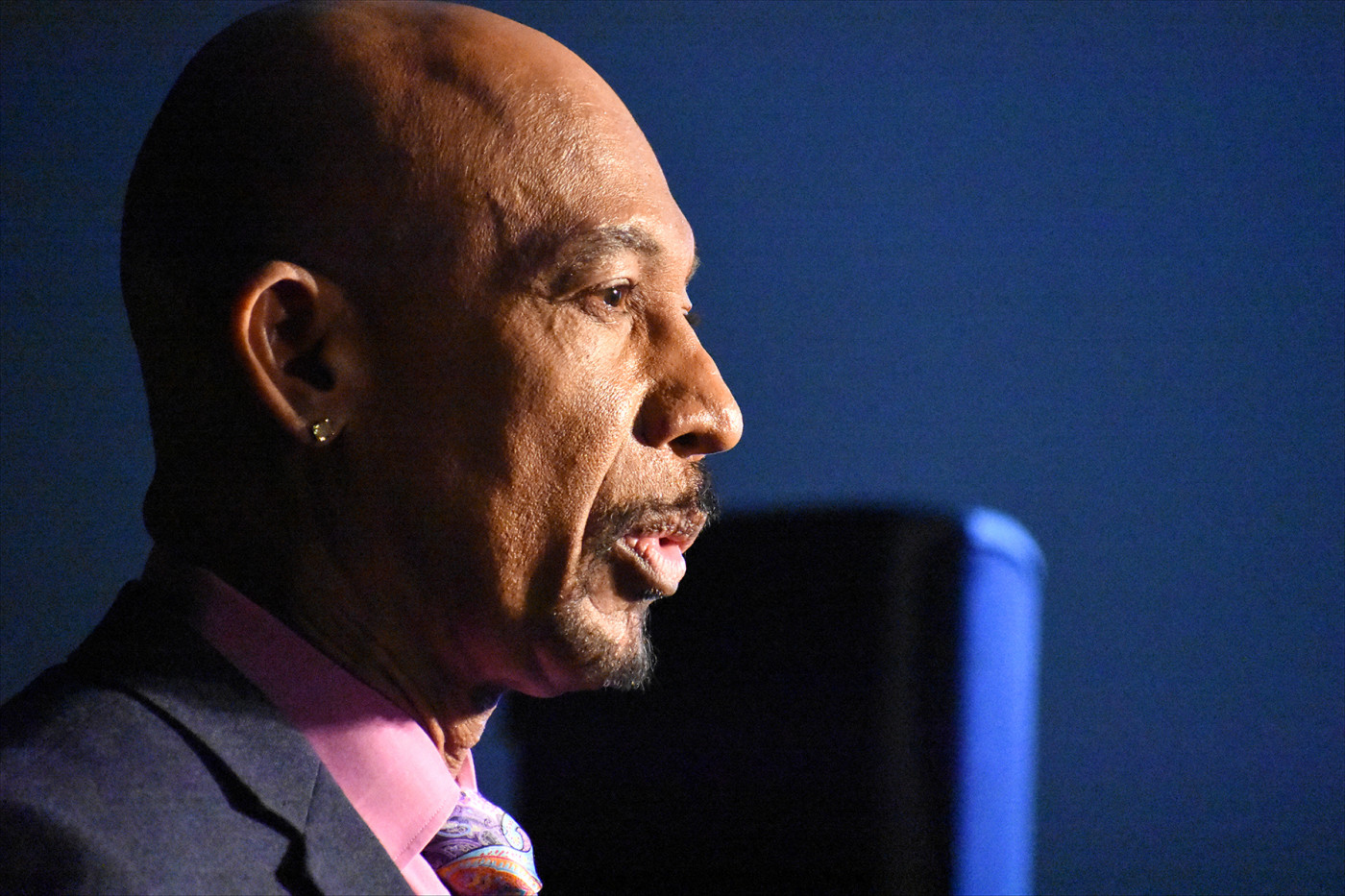

Into the a news conference following the central bank’s Sep plan conference, Given Couch Jerome Powell mentioned that straight down mortgage prices can assist thaw the fresh new housing industry, that has been suspended positioned due to what is actually also known as the newest rate-lock feeling. Residents have been capable secure cheaper mortgage rates ahead of 2022 was indeed reluctant to refinance otherwise promote their houses once the they had have more costly financial rates in the process.