Melhores Cassinos Online Acercade 2024

24 de setembro de 2024Cassino Online Brasil Melhores Cassinos 09 2024

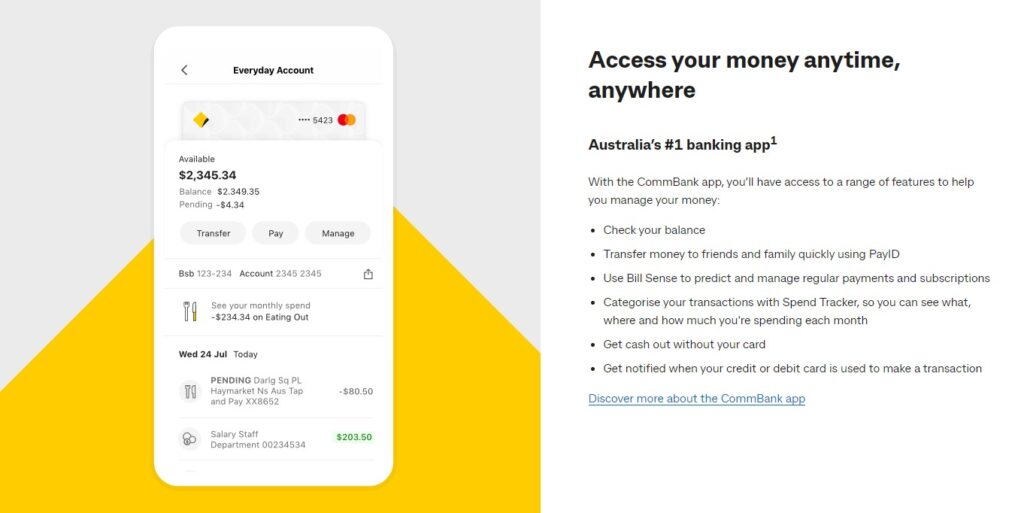

24 de setembro de 2024- Apply Today

- Have a look at Rates

- Pick A mobile Financial Manager

- Financing

- Mortgage brokers

- Strengthening a house

If you were thinking about strengthening the home you’ve always need, planning the http://cashadvancecompass.com/loans/fast-payday-loans latest loans would-be easier than just you realise.

In which carry out We begin ?

Of as low as good 10% deposit, you might create rather than to find a current assets. Building a new domestic actually at the mercy of the brand new RBNZ loan so you’re able to worthy of constraints.

There are numerous things to consider when considering building your own house. While you are prepared to take on a creating investment, the initial step is to obtain the funds manageable. So it assurances you will end up confident in finding that perfect part, or talking to regional create businesses that have an obvious budget within the mind.

Contact us to talk through the tips inside it to bring their strengthening venture to life the audience is right here to aid.

- Make programs

- Come across a part

- Come across a structure

Obtaining a building mortgage

Out-of only a great ten% put, you could generate as opposed to to invest in a current property. Strengthening a different sort of home isn’t at the mercy of the borrowed funds so you’re able to value limitations (in case the loan is eligible ahead of time building). Talk to one of the class to see if you might be qualified.

KiwiSaver Very first Home Give

If you’ve contributed for three ages on the KiwiSaver you can be eligible for a good KiwiSaver Very first Family Give. The KiwiSaver Basic House Grant provides qualified basic-home buyers that have an offer to get towards the purchase of an existing/older household. The new offer shall be around $5,100000 for those and up to $10,100000 in which there have been two or maybe more qualified people.

KiwiSaver Basic Family Offer requirements

You truly need to have discussed frequently in order to KiwiSaver having a minimum of three years, no less than this new restricted allowable portion of your own total earnings.

Generated $95,100 otherwise less (just before income tax) during the last 1 year due to the fact a best buyer, or if 2 or more people a mixed income of $150,one hundred thousand otherwise shorter (just before taxation) over the last 12 months.

Enjoys in initial deposit that is 5% or even more of cost. For example the latest KiwiSaver very first household detachment, Very first House Give and any other financing for example deals, otherwise in initial deposit talented by a family member.

Look for a section

The next thing is to find the prime destination to lay your brand new family. You may choose to see a blank part that meets your own requirements before carefully deciding into the household decide to build on it.

As an alternative, a house and residential property bundle could be the trusted alternative where you will get input into house build but don’t enjoys to be concerned about dealing with that which you your self.

When you’re fortunate discover that the best home is currently oriented, the purchase of the house would-be considered beneath the the build’ mortgage so you can value restrictions. Meaning you may also only need a beneficial ten% put to shop for they. The house has to be significantly less than six months old and you can hasn’t started prior to now filled so you’re able to meet the requirements.

Discover a design

Building enterprises get pre-removed preparations you can use and you can adapt to suit your needs. Keep in mind you to definitely to make changes to those plans may improve the cost so it is advisable that you reason behind a boundary so you’re able to support these transform.

Knowing just what you are shortly after, you may make a custom made household build due to a designer and you may then get that package cost upwards thanks to a creator.

There are many different choices to in search of your dream family. Your decision is dependent upon the kind of house you would like, your financial budget as well as how much enter in you need on house framework.

After you’ve made a decision, your preparations will should be submitted to your regional council to acquire a creating agree.

The create initiate

Really produces need the webpages becoming removed and alot more difficult internet, retaining wall space and you can posts could need to be put positioned just before functions can start toward setting the fresh new foundations. Based on exactly what behavior you have made for your house construct it can take from around two months in order to 1 year doing.

Information improvements repayments

If you are strengthening, advances payments are made to their creator from inside the amounts. Which ensures you might be only spending money on work which was done from inside the build.

The cash sum would-be used very first, upcoming because the significant levels of the make is accomplished, costs was taken down from your loan and you will paid actually to your creator.

Approaching achievement of one’s new house

You will be informed out of a romantic date the creator have a tendency to give the property more – and here you’ll get this new secrets to your household!

For us to produce the very last payment you’ll want to let united states see whenever one to handover date try, and offer you to the adopting the files: